Question: The revenues, expenses, assets, and liabilities reported by an organization provide data that are essential for decision making. The informational value of these figures enables a thorough analysis of an organization and its financial health and future prospects. How do outsiders learn of these amounts? How are financial data actually conveyed to interested parties? For example, a company such as Marriott International Inc. (the hotel chain) has possibly millions of current and potential shareholders, creditors, and employees. How does such a company communicate vital financial information to all the groups and individuals that might want to make some type of considered evaluation?

Answer: Businesses and other organizations periodically produce financial statements that provide a formal structure for conveying financial information to decision makers. Smaller organizations distribute such statements each year, frequently as part of an annual report prepared by management. Larger companies, like Marriott International, issue yearly statements but also prepare interim statements, usually on a quarterly basis1. Regardless of the frequency of preparation, financial statements serve as the vehicle to report all the monetary balances and explanatory information required according to the rules and principles of U.S. generally accepted accounting principles (U.S. GAAP). Based on these standards, such statements are intended as a fairly presented portrait of the organization—one that contains no material misstatements. In simple terms, a company’s revenues, expenses, assets, and liabilities are reported to outsiders by means of its financial statements.

Typically, a complete set of financial statements produced by a business includes four separate statements along with comprehensive notes. When studied with knowledge and understanding, a vast array of information becomes available to aid decision makers who want to predict future stock prices, cash dividend payments, and cash flows.

Financial Statements and Accompanying Notes2

v Income statement (also called a statement of operations or a statement or earnings)3

v Statement of retained earnings (or the more inclusive statement of stockholders’ equity)

v Balance sheet (also called a statement of financial position)

v Statement of cash flows

The four financial statements prepared by Marriott International as of January 2, 2009, and the year then ended were presented in just four pages of its annual report (pages forty-three through forty-six) whereas the notes accompanying those statements made up the next twenty-seven pages. Although decision makers often focus on a few individual figures found in financial statements, the vast wealth of information provided by the notes should never be ignored.

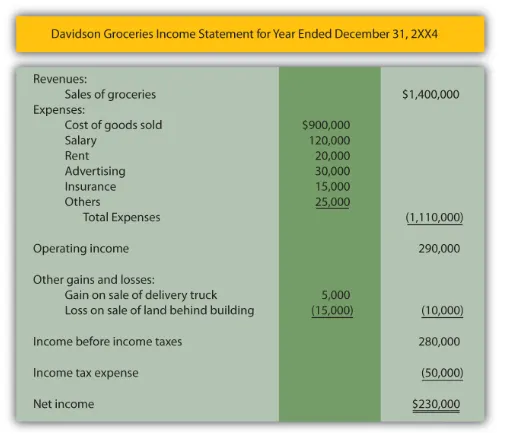

Question: Is nothing else presented on an income statement other than revenues and expenses?

Answer: An income statement also reports gains and losses for the same period of time. A gain is an increase in the net assets of an organization created by an occurrence outside its primary or central operations. A loss is a decrease in net assets from a similar type of incidental event.

When Apple sells a computer to a customer, it reports revenue but if the company disposes of a piece of land adjacent to a warehouse, it reports a gain (if sold above cost) or a loss (if sold below cost). Selling computers falls within Apple’s primary operations whereas selling land does not. If Pizza Hut sells a pepperoni pizza, the transaction brings in assets. Revenue has been earned and should be reported. If this same company disposes of one of its old stoves, the result is reflected as either a gain or loss. Pizza Hut is not in the business of selling appliances. This classification split between revenues/expenses and gains/losses helps provide decision makers with a clearer portrait of what actually happened to the company during the reporting period.

An example of an income statement for a small convenience store is shown in Figure 3.1 Note that the name of the company, the identity of the statement, and the period of time reflected are apparent. Although this is only an illustration, it is quite similar to the income statements created by virtually all business organizations in the United States and many other countries.