Question: The second financial statement is known as the statement of retained earnings1.The term retained earnings has not yet been introduced. What information does a retained earnings balance communicate to an outside decision maker? For example, on January 31, 2009, Barnes & Noble reported retained earnings of nearly $721 million, one of the larger amounts found in the company’s financial statements. What does that figure tell decision makers about this bookstore chain?

Answer: Retained earnings is one of the most misunderstood accounts in all of financial reporting. In simplest terms, this balance is merely the total amount of net income reported by a company since it first began operations, less all dividends paid to stockholders during that same period. Thus, the figure provides a measure of the profits left in a business throughout its history to create growth.

When a company earns income, it becomes larger because net assets have increased. Even if a portion of the profits is later distributed to shareholders as a dividend, the company has grown in size as a result of its own operations. The retained earnings figure informs decision makers of the amount of that internally generated expansion. The reported balance answers the question: How much of the company’s net assets have been derived from operations during its life?

If a company reports net income of $10,000 each year and then pays a $2,000 dividend to its owners, it is growing in size at the rate of $8,000 per year. After four years, for example, $32,000 ($8,000 × four years) of its net assets were generated by its own operating activities. That information is communicated through the retained earnings balance.

As of January 31, 2009, Barnes & Noble reported total assets of $3.0 billion and liabilities of $2.1 billion. Thus, the company had net assets of $900 million. It held that many more assets than liabilities. Those additional assets did not appear by magic. They had to come from some source. One of the primary ways to increase the net assets of a company is through profitable operations. The balance for retained earnings shown by Barnes & Noble at this time lets decision makers know that approximately $721 million of its net assets were generated by the net income earned since the company’s inception, after all dividend distributions to shareholders were subtracted.

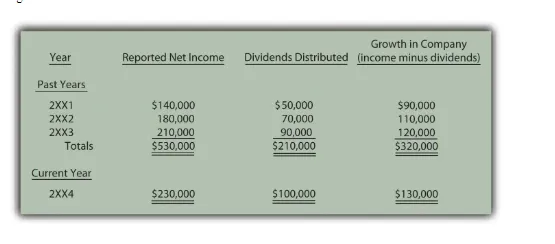

Question: In Figure 3.1 “Income Statement”, Davidson Groceries calculated its net income for 2XX4 as $230,000. Assume that this company began operations on January 1, 2XX1, and reported the following balances over the years:

How is this information reported?

What is the structure of the statement of retained earnings as it appears within a company’s financial statements?

Answer: In its three prior years of existence, Davidson Groceries’ net assets increased by a total of $320,000 as a result of its operating activities. As can be seen here, the company generated total profit during this period of $530,000 while distributing dividends to shareholders amounting to $210,000, an increase of $320,000. Net assets rose further during the current year (2XX4) as Davidson Groceries made an additional profit (see also Figure 3.1 “Income Statement”) of $230,000 but distributed $100,000 in dividends.

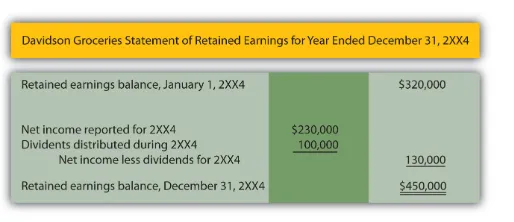

Figure 3.4 “Statement of Retained Earnings” shows the format by which this information is conveyed to the decision makers who are evaluating Davidson Groceries.

Figure 3.4 Statement of Retained Earnings