Question: The second adjustment to be considered here involves the handling of prepaid expenses. In the transactions that were recorded in the previous chapter, Journal Entry 10 reported a $4,000 payment made in advance for four months of rent to use a building. An asset—prepaid rent—was recorded through the normal accounting process. This account is listed on the trial balance in Figure 5.1 “Updated Trial Balance”. Why might a year-end adjusting entry be needed in connection with a prepaid expense?

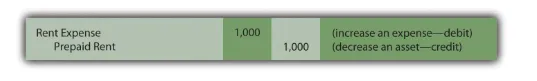

Answer: During these four months, the Lawndale Company will use the rented facility to help generate revenue. Over that time, the future economic benefit established by the payment gradually becomes a past benefit. The asset literally changes into an expense day by day. For illustrative purposes, assume that one month has now passed since the original payment. This month of benefit provided by the rent ($1,000 or $4,000/four months) no longer exists; it has been consumed.

As a preliminary step in preparing financial statements, an adjusting entry is needed to reclassify $1,000 from the asset into an expense account. This adjustment leaves $3,000 in the asset (for the remaining three months of rent on the building) while $1,000 is now reported as an expense (for the previous one month of rent).

The basic purpose of adjusting entries is to take whatever amounts reside in the ledger and align them with the requirements of U.S. generally accepted accounting principles (U.S. GAAP). For this illustration, the original $4,000 payment was classified as a prepaid rent and the adjustment above was created in response to that initial entry.

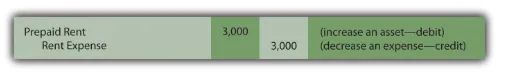

In recording transactions, some accounting systems mechanically handle events in a different manner than others. Thus, construction of an adjusting entry always depends on the recording that previously took place. To illustrate, assume that when this $4,000 payment was made, the company’s computer program had been designed to enter a debit to rent expense rather than to prepaid rent. All money spent for rent was automatically recorded as rent expense. This initial accounting has no impact on the final figures to be reported but does alter the adjustment process.

An adjusting entry still needs to be prepared so that the expense appearing on the income statement is $1,000 (for the past one month) while the asset on the balance sheet is shown as $3,000 (for the next three months). If the entire cost of $4,000 is in rent expense, the following alternative is necessary to arrive at the proper balances. It shifts $3,000 out of the expense and into the asset.

This entry leaves $1,000 in expense and $3,000 as the asset. Regardless of the account, the accountant first determines the balance that is present in the ledger and then creates the specific adjustment needed to arrive at fairly presented figures.

Question: Accrued revenue is the third general type of adjustment to be covered here. Based on the title, this revenue is one that grows gradually over time. If not recorded by a company’s accounting system, updating is necessary before financial statements are prepared. What adjustment is used to recognize accrued revenue that has not previously been recorded?

Answer: Various types of revenue are earned as time passes rather than through a physical event such as the sale of inventory. To illustrate, assume that a customer comes to the Lawndale Company five days before the end of the year and asks for assistance. The customer must be away for the next thirty days and wants company employees to feed, water, and care for his horses during the period of absence. Everything needed for the job is available at the customer’s farm; Lawndale just has to provide the service. The parties agree that the company will receive $100 per day for this work with payment to be made upon the person’s return.

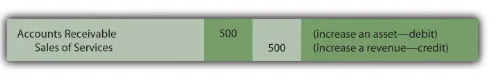

No asset changes hands at the start of this task. Thus, the company’s accounting system is not likely to make any entry until payment is eventually received. However, assume that after the first five days of work, the company is ready to prepare financial statements and needs to recognize all revenue earned to date. The service to this customer has been carried out for five days at a rate of $100 per day. The company has performed the work to earn $500, an amount that will not be received until later. This receivable and revenue should be recognized through an adjusting entry so that the reported financial figures are fairly presented. The earning process for the $500 occurred this year and should be recorded in this year.