Question: The company in this illustration expects to collect an amount from its receivables that will not materially differ from $93,000. The related $7,000 expense is recorded in the same period as the revenue through an adjusting entry. What happens when an actual account is determined to be uncollectible? For example, assume that on March 13, Year Two, a $1,000 balance proves to be worthless. The customer dies, declares bankruptcy, disappears, or just refuses to make payment. This is not a new expense; $7,000 was already anticipated and recognized in Year One. It is merely the first discovery. How does the subsequent write-off of a receivable as being uncollectible affect the various T-account balances?

Answer: When an account proves to be uncollectible, the receivable T-account is decreased. The $1,000 balance is simply removed. It is no longer viewed as an asset because it does not have future economic benefit. Furthermore, the anticipated amount of bad accounts is no longer $7,000. Because this first worthless receivable has been identified and eliminated, only $6,000 remains in the allowance.

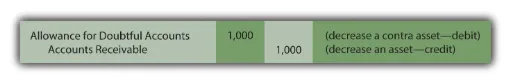

The following journal entry is made to write off this account. This entry is repeated whenever a balance is found to be worthless. No additional expense is recognized. The expense was estimated and recorded in the previous period based on applying accrual accounting and the matching principle.

The two basic steps in the recording of doubtful accounts are:

The amount of bad accounts is estimated whenever financial statements are to be produced. An adjusting entry then recognizes the expense in the same period as the sales revenue. It also increases the allowance for doubtful accounts (to reduce the reported receivable balance to its anticipated net realizable value).

Subsequently, whenever a specific account is deemed to be worthless, the balance is removed from both the accounts receivable and the allowance for doubtful accounts T-accounts. The related expense has been recognized previously and is not affected by the removal of the uncollectible account.

Question: After an account receivable has been written off as uncollectible, does the company cease in its attempts to collect the amount due from that customer?

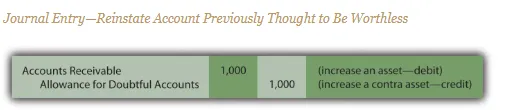

Answer: Organizations always make every possible effort to recover any money that they are owed. Writing off an account simply means that the chances of collection are judged to be slim. However, efforts to force payment will continue, often with increasingly aggressive techniques. If money is ever received from a written off account, the company first reinstates the account by reversing the earlier entry. Then, the cash received is recorded in the normal fashion. To illustrate, assume that the above account is eventually collected from this customer.

Question: In this illustration, at the end of Year One, the company estimated that $7,000 of its accounts receivable will ultimately prove to be uncollectible. However, in Year Two, that figure is likely to be proven wrong. The actual amount might well be $6,000 or $8,000 or many other numbers. When the precise figure is known, does a company return to its Year One financial statements and adjust them to this correct balance? Should a company continue reporting an estimated figure once it has been shown to be incorrect?

Answer: According to U.S. GAAP, if a number is reported based on a reasonable estimation, any subsequent differences with actual amounts are not handled retroactively (by changing the previously released figures). For example, if uncollectible accounts here prove to be $8,000, the company does not adjust the balance reported as the Year One bad debt expense from $7,000 to $8,000. It continues to report $7,000 for that period even though that number is now known to be wrong.As will be discussed in subsequent chapters, previously issued financial statements are restated if found to contain material misstatements or in a few other specific circumstances. However, a difference between an actual figure and a reasonable estimation is not handled in this manner. In real life, determining whether a previously reported amount was a reasonable estimation can be the subject of intense debate.

There are several practical reasons for the accountant’s unwillingness to adjust previously reported estimations unless they were clearly unreasonable or fraudulent:

1. Most decision makers are well aware that many reported figures only present estimates. Discrepancies are expected and should be taken into consideration when making decisions based on numbers presented in a set of financial statements. In analyzing this company and its financial health, astute investors and creditors anticipate that the total of bad accounts will ultimately turn out to be an amount around $7,000 rather than exactly $7,000.

2. Because an extended period of time often exists between issuing statements and determining actual balances, most parties will have already used the original information to make their decisions. Knowing the exact number now does not allow them to undo those prior actions. There is no discernable benefit from having updated figures as long as the original estimate was reasonable.

3. Financial statements contain numerous estimations and nearly all will prove to be inaccurate to some degree. If exactness were required, correcting each of these previously reported figures would become virtually a never-ending task for a company and its accountants. Scores of updated statements might have to be issued before a “final” set of financial figures became available after several years. For example, the exact life of a building might not be known for fifty years. Decision makers want information that is usable as soon as possible. Speed in reporting is more important than absolute precision.

4. At least theoretically, half of the differences between actual and anticipated results should make the reporting company look better and half make it look worse. If so, the corrections needed to rectify all previous estimation errors will tend to offset and have little overall impact on a company’s reported income and financial condition.

5. Thus, no change is made in financial figures that have already been released whenever a reasonable estimation proves to be wrong. However, differences that arise should be taken into consideration in creating current and subsequent statements. For example, if the Year One bad debts were expected to be 7 percent, but 8 percent actually proved to be uncollectible, the accountant might well choose to use a higher percentage at the end of Year Two to reflect this new knowledge.