In compensating for the failure of markets to supply public andmerit goods, central and local government can intervene. In the case of pure public goods, such as defence and street lighting, the case for intervention is clear and unambiguous. However, in the case of merit goods and quasi public goods, there are disagreements about the precise role of government.

Most economists argue that governments have a crucial role in allocating resources to merit goods such as education and healthcare. Other economists prefer to highlight the failure of governments to allocate resources efficiently. These free-market economists argue that markets should be encouraged to work whenever possible, even in terms of the provision of merit goods.

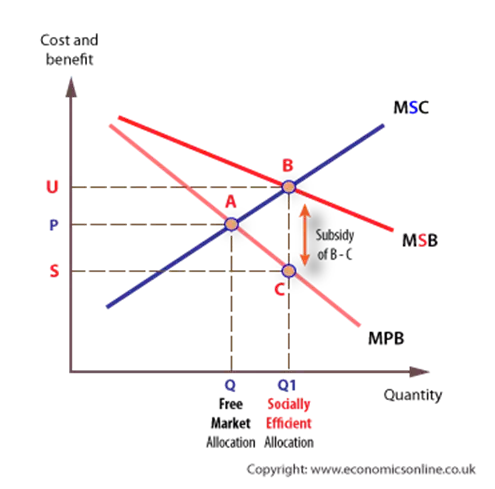

Subsidies

There is much debate about the extent to which higher education should be subsidised. Subsidies are one way to help achieve the socially optimal number of students going to university. The challenge is to achieve Q1 students, the socially efficient number, but universities need a fee of U to cover their costs of supply, at B. However, students will only be prepared to pay S, at C, which reflects their expectation of private benefit.

A subsidy of B – C (U – S) would provide the necessary incentives for universities to supply Q1 places, and for students to take-up this number.

If funded in this way, students would contribute part of the real cost of their education by paying C, which is equivalent to the private benefit they expect to derive, and ‘society’, would contribute a further part of the cost of education (B – C) equivalent to the external benefit which is derived by society. This subsidy would be funded through taxation.

A graduate tax

In addition, or alternatively, a graduate tax can be justified to enable students to attend university at zero fees, or heavily discounted fees, while paying for the future benefit they will derive out of the income they gain from employment in the future.