Economic analysis is the most crucial phase in managerial economics. A manager has to collect and study the economic data of the environment in which a firm operates. He has to conduct a detailed statistical analysis in order to do research on industrial markets. The research may comprise of information regarding tax rates, products, competitor’s pricing strategies, etc., which may be useful for managerial decision-making.

Optimization techniques are very crucial activities in managerial decision-making process. According to the objective of the firm, the manager tries to make the most effective decision out of all the alternatives available. Though the optimal decisions differ from company to company, the objective of optimization technique is to obtain a condition under which the marginal revenue is equal to the marginal cost.

The first step in presenting optimization techniques is to examine the methods to express economic relationship. Now let’s have a look at the methods of expressing economic relationship −

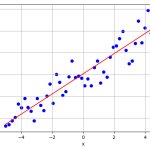

● Equations, graphs, and tables are extensively used for expressing economic relationships.

● Graphs and tables are used for simple relationships and equations are used for complex relationships.

● Expressing relationships through equations is very useful in economics as it allows the usage of powerful differential technique, in order to determine the optimal solution of the problem.

Now suppose, we have total revenue equation −

TR = 100Q − 10Q2

Substituting values for quantity sold, we generate the total revenue schedule of the firm −

| 100Q − 10Q2 | TR |

| 100(0) − 10(0)2 | $0 |

| 100(1) − 10(1)2 | $90 |

| 100(2) − 10(2)2 | $160 |

| 100(3) − 10(3)2 | $210 |

| 100(4) − 10(4)2 | $240 |

| 100(5) − 10(5)2 | $250 |

| 100(6) − 10(6)2 | $240 |

Relationship between total, marginal, average concepts, and measures is really crucial in managerial economics. Total cost comprises of total fixed cost plus total variable cost or average cost multiply by total number of units produced

TC = TFC + TVC or TC = AC.Q

Marginal cost is the change in total cost resulting from one unit change in output. Average cost shows per unit cost of production, or total cost divided by number of units produced.

Optimization Analysis

Optimization analysis is a process through which a firm estimates or determines the output level and maximizes its total profits. There are basically two approaches followed for optimization −

● Total revenue and total cost approach

● Marginal revenue and Marginal cost approach

Total Revenue and Total Cost Approach

According to this approach, total profit is maximum at the level of output where the difference between the TR and TC is maximum.

Π = TR − TC

When output = 0, TR = 0, but TC = 20,sototalloss=20,sototalloss=20

When output = 1, TR = 90,andTC=90,andTC=140, so total loss = $50

At Q2, TR = TC = $160, therefore profit is equal to zero. When profit is equal to zero, it means that firm reached a breakeven point.

Marginal Revenue and Marginal Cost Approach

As we have seen in TR and TC approach, profit is maximum when the difference between them is maximum. However, in case of marginal analysis, profit is maximum at a level of output when MR is equal to MC. Marginal cost is the change in total cost resulting from one unit change in output, whereas marginal revenue is the change in total revenue resulting from one unit change in sale.

According to marginal analysis, as long as marginal benefit of an activity is greater than marginal cost, it pays for an organization to increase the activity. The total net benefit is maximum when the MR equals the MC.