What is Interest Rate Parity?

Interest Rate Parity (IRP) is a theory in which the differential between the interest rates of two countries remains equal to the differential calculated by using the forward exchange rate and the spot exchange rate techniques. Interest rate parity connects interest, spot exchange, and foreign exchange rates. It plays a crucial role in Forex markets.

IRP theory comes handy in analyzing the relationship between the spot rate and a relevant forward (future) rate of currencies. According to this theory, there will be no arbitrage in interest rate differentials between two different currencies and the differential will be reflected in the discount or premium for the forward exchange rate on the foreign exchange.

The theory also stresses on the fact that the size of the forward premium or discount on a foreign currency is equal to the difference between the spot and forward interest rates of the countries in comparison.

Example

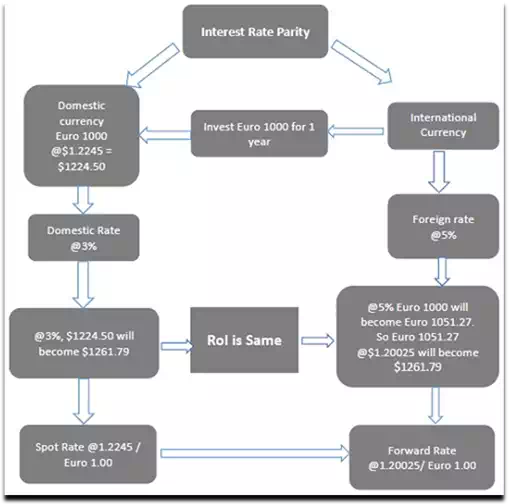

Let us consider investing € 1000 for 1 year. As shown in the figure below, we’ll have two options as investment cases −

Case I: Home Investment

In the US, let the spot exchange rate be $1.2245 / €1.

So, practically, we get an exchange for our €1000 @ $1.2245 = $1224.50

We can invest this money $1224.50 at the rate of 3% for 1 year which yields $1261.79 at the end of the year.

Case II: International Investment

We can also invest €1000 in an international market, where the rate of interest is 5.0% for 1 year.

So, €1000 @ of 5% for 1 year = €1051.27

Let the forward exchange rate be $1.20025 / €1.

So, we buy forward 1 year in the future exchange rate at $1.20025/€1 since we need to convert our €1000 back to the domestic currency, i.e., the U.S. Dollar.

Then, we can convert € 1051.27 @ $1.20025 = $1261.79

Thus, when there is no arbitrage, the Return on Investment (ROI) is equal in both cases, regardless the choice of investment method.

Arbitrage is the activity of purchasing shares or currency in one financial market and selling it at a premium (profit) in another.