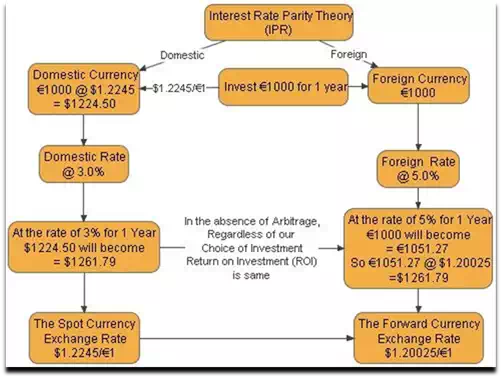

If IRP theory holds, then it can negate the possibility of arbitrage. It means that even if investors invest in domestic or foreign currency, the ROI will be the same as if the investor had originally invested in the domestic currency.

● When domestic interest rate is below foreign interest rates, the foreign currency must trade at a forward discount. This is applicable for prevention of foreign currency arbitrage.

● If a foreign currency does not have a forward discount or when the forward discount is not large enough to offset the interest rate advantage, arbitrage opportunity is available for the domestic investors. So, domestic investors can sometimes benefit from foreign investment.

● When domestic rates exceed foreign interest rates, the foreign currency must trade at a forward premium. This is again to offset prevention of domestic country arbitrage.

● When the foreign currency does not have a forward premium or when the forward premium is not large enough to nullify the domestic country advantage, an arbitrage opportunity will be available for the foreign investors. So, the foreign investors can gain profit by investing in the domestic market.