Due to demand and supply, there is always an exchange rate that keeps changing over time. The rate of exchange is the price of one currency expressed in terms of another. Due to increased or decreased demand, the currency of a country always has to maintain an exchange rate. The more the exchange rate, the more is the demand of that currency in forex markets.

Exchanging the currencies refer to trading of one currency for another. The value at which an exchange of currencies takes place is known as the exchange rate. The exchange rate can be regarded as the price of one particular currency expressed in terms of the other one, such as £1 (GBP) exchanging for US$1.50 cents.

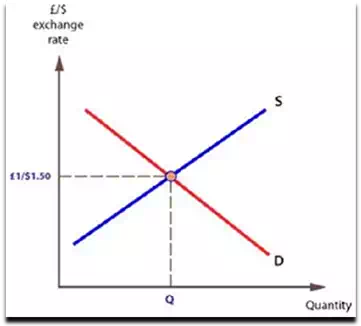

The equilibrium between supply and demand of currencies is known as the equilibrium exchange rate.

Example

Let us assume that both France and the UK produce goods for each other. They will naturally wish to trade with each other. However, the French producers will have to pay in Euros and the British producers in Pounds Sterling. However, to meet their production costs, both need payment in their own local currency. These needs are met by the forex market which enables both French and British producers to exchange currencies so that they can trade with each other.

The market usually creates an equilibrium rate for each currency, which will exist where demand and supply of currencies intersect.