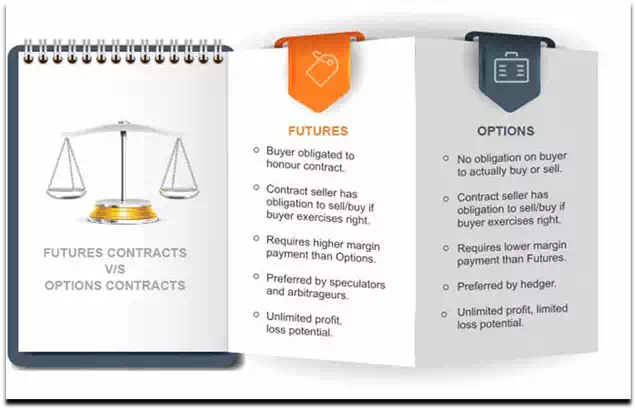

The basic and most prominent difference between options and futures is related with the obligations they create on part of the buyers and sellers.

● An option offers the buyer the basic right, but not an obligation, to buy (or sell) a certain kind of asset at a decided or settled price, which is specific at any time while the contract is alive.

● On the other hand, a futures contract offers the buyer the obligation to buy a specific asset, and the seller the obligation to sell and deliver that asset on a specific future date, provided the holder does not close the position prior to expiration.

● An investor can go in into a futures contract with no upfront cost apart from commissions, whereas purchasing an options position does not need to pay a premium. While comparing the absence of any upfront cost of futures, the premium of the option can be considered as the fee for not being obligated to purchase the underlying asset in the case of an adverse movement in prices. The premium paid on the option is the maximum value a purchaser can lose.

● Another important difference between futures and options is the size of the given or underlying position. Usually, the underlying position is considerably bigger in case of futures contracts. Moreover, the obligation to purchase or sell this given amount at a settled price turns the futures a bit riskier for an inexperienced investor.

● The final and one of the prominent differences between futures and options is the way the gains or earnings are obtained by the parties. In case of an option, the gains can be realized in the following three ways −

○ Exercising the option when it is deep in the money,

○ Going to the market and taking the opposite position, or

○ Waiting until expiry and gaining the gap between the asset and the strike prices.

On the other hand, gains on the futures positions are naturally ‘marked to market’ every day. This means that the change in the price of the positions is assigned to the futures accounts of the parties at the end of every trading day. However, a futures call-holder can also realize gains by going to the market and opting for the opposite position.