Departmental stores have many types of stores under a single roof, for example one departmental store may have a cosmetic store, shoe store, stationery store, readymade departmental store, grocery stores, medicines, and many more.

It is essential to know the profit and loss account of each departmental store at the end of the accounting year. However, it can be done by maintaining the department wise Trading & Profit and Loss account.

Objectives of Departmental Accounting

Following are the main objectives of the departmental accounting −

· To know the financial position of each and every department separately, it is helpful to make a comparison.

· Calculate commission of the managers department wise.

· Evaluate performance, planning, and control.

Advantages of Departmental Accounting

Following are the advantages of a department accounting −

· It is helpful in evaluating the result of each department.

· It helps to know the profitability of each department.

· Investors and outsiders may know the detailed information.

· It is helpful in making comparison of each expenses (same department) of the different accounting years and different expenses (other departments) of the same accounting year.

Methods of Departmental Account

There are two methods of keeping Departmental Accounts −

- Separate Set of Books for each department

- Accounting in Columnar Books form

Separate Set of Books for each Department

Under this method of accounting, each department is treated as a separate unit and separate set of books are maintained for each unit. Financial results of each unit are combined at the end of accounting year to know the overall result of the store.

Due to high cost, this method of accounting is followed only by very big business houses or where to do so is compulsory as per the law. Insurance business is one of the best examples, where to follow this system is compulsory.

Accounting in Columnar Books Form

Small trading unit generally uses this system of accounting, where accounts of all departments are maintained together by central accounts department in the columnar books form. Under this method, sale, purchase, stock, expenses, etc. are maintained in a columnar form.

It is necessary that to prepare a departmental Trading and Profit and Loss Account, preparation of subsidiary books of accounts having different columns for the different department is required. Purchase Book, Purchase Return Book, Sale Book, Sales return books etc. are the examples of the subsidiary books.

Specimen of a Sale Book is given below −

Sales Book

| Date | Particulars | L.F. | Department A | Department B | Department C | Department D |

A Trading account in columnar form is prepared to know the department wise gross profit of the concern.

Function wise classification may also be done in a business unit like Production department, Finance department, Purchase department, Sale department, etc.

Allocation of Department Expenses

· Some expenses, which are specially incurred for a particular department may be charged directly to the respective department. For example, hiring charges of the transport for delivery of goods to customer may be charged to the selling and distribution department.

· Some of the expenses may be allocated according to their uses. For example, electricity expenses may be divided according to the sub meter of each department.

Following are the examples of some expenses, which are not directly related to any particular department may be divide as −

· Cartage Freight Inward Account − Above expenses may be divided according to purchase of each department.

· Depreciation − Depreciation may be divided according to the value of assets employed in each department.

· Repairs and Renewal Charges − Repair and renewal of the assets may be divided according to the value of the assets used by each department.

· Managerial Salary − Managerial salary should be divided according to the time spent by the manager in each department.

· Building Repair, Rents & Taxes, Building Insurance, etc.− All the expenses related to the building should be divided according to the floor space occupied by each department.

· Selling and Distribution Expenses − All the expenses relating to selling and distribution expenses should be divided according to the sales of each department, such as freight outward, travelling expenses of sales personals, salary and commission paid to salesmen, after sales services expenses, discount and bad debts, etc.

· Insurance of Plant & Machinery − The value of such Plant & Machinery in each department is the basis of the insurance.

· Employee/worker Insurance − Charges of a group insurance should be divided according to the direct wage expenses of each department.

· Power & Fuel − Power & fuel will be allocated according to the working hours and power of the machine (i.e. Hours worked x Horse power).

Inter-Department Transfer

An inter-department analysis sheet is prepared at a regular interval such as weekly or monthly basis to record all the inter-departmental transfers of goods and services. It is necessary, as each department is working as a separate profit center. Transfer of the prices of such transactions can be cost base, market price, or duel basis.

Following Journal entry will pass at the end of that period (weekly or monthly) −

Journal Entry

Receiving Department A/c Dr

To Supplying Department A/c

Inter-Department Transfer Price

There are three types of transfer prices −

· Cost based transfer price − Where the transfer price is based on standard, actual, or total cost, or marginal cost is called cost based transfer price.

· Market based transfer price − Where the goods are transferred at selling price from one department to another is known as market based price. Therefore, unrealized profit on the goods sold is debited from the selling department in the form of a stock reserve for both the opening and the closing stock.

· Dual pricing system − Under this system, the goods are transferred on the selling price by the transferor department and booked at the cost price by the transferee department.

Illustration

Please prepare a Departmental Trading and Profit and Loss Account & General Profit and Loss Account for the year ended 31-12-2014 of M/s Andhra & Company where department A sells goods to department B on Normal selling price.

| Particulars | Dept. A | Dept. B |

| Opening stock | 175,000 | – |

| Purchases | 4,025,000 | 350,000 |

| Inter Transfer of Goods | – | 1,225,000 |

| Wages | 175,000 | 280,000 |

| Electricity Expenses | 17,500 | 245,000 |

| Closing Stock (at cost) | 875,000 | 315,000 |

| Sales | 4,025,000 | 2,625,000 |

| Office Expenses | 35,000 | 28,000 |

| Combined Expenses for both Department | ||

| Salaries (2:1 Ratio) | 472,500 | |

| Printing and Stationery Expenses (3:1 Ratio) | 157,500 | |

| Advertisement Expenses ( Sale Ratio) | 1,400,000 | |

| Depreciation (1:3 Ratio) | 21,000 |

Solution

M/s Andhra & Company

Departmental Trading and Profit and Loss Account

For the year ended 31-12-2014

| Particulars | Dept. A | Dept. B | Particulars | Dept. A | Dept. B |

| To Opening StockTo PurchasesTo Transfer from ATo WagesTo Gross Profit c/d | 175,0004,025,000175,0001,750,000 | –350,0001,225,000280,0001,085,000 | By SalesBy Transfer to BBy Closing Stock | 4,025,0001,225,000875,000 | 2,625,000—-315,000 |

| Total | 6,125,000 | 2,940,000 | Total | 6,125,000 | 2,940,000 |

| To Electricity ExpensesTo Office ExpensesTo Salaries (2:1 ratio)To Printing &Stationery (3:1 Ratio)To Advertisement Exp.( Sales Ratio 40.25 :26.25)To Depreciation (1:3 Ratio)To Net Profit | 17,50035,000315,000118,125847,3685,250411,757 | 245,00028,000157,50039,375552,63215,75046,743 | By Gross Profit b/d | 1,750,000 | 1,085,000 |

| Total | 1,750,000 | 1,085,000 | Total | 1,750,000 | 1,085,000 |

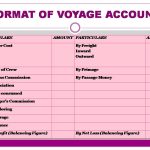

General Profit and Loss Account

For the year ended 31-12-2014

| Particulars | Dept. A | Particulars | Dept. B |

| To Stock reserve (Dept. B)To Net Profit c/d | 81,667376,833 | By Departmental Net Profit b/dDept. A411,757Dept. B46,743————- | 458,500 |

| Total | 458,500 | Total | 458,500 |