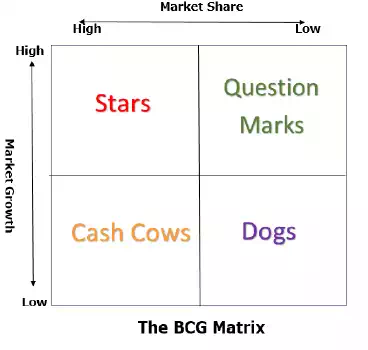

The Boston Consulting Group (BCG) matrix is the most popular approach to portfolio planning. The matrix categorizes a firm’s businesses as high or low along two dimensions: the market share and the growth rate of its industry.

The high market share units that have a slow-growth industry are called cash cows. As their industries have quite bleak prospects, profits generated from cash cows should not be invested back into cash cows but rather they should be diverted to more promising businesses.

Low market share units that fall within slow-growing industries are called dogs. These units are good for divestments.

High market share units that fall within fast-growing industries are known as stars. These units have very bright prospects and thus are considered good candidates for growth.

Low market share units that fall within fast-growing industries are called question marks. These units can either be converted into stars or divested.

The BCG matrix is not the only one portfolio planning technique. GE has developed the attractiveness-strength matrix to examine its portfolio of diverse activities. This planning technique involves rating each of the firm’s businesses in regard to attractiveness and the firm’s strength within the industry. Each dimension is usually divided into three categories that result in nine boxes. Each of these boxes have a given set of recommendations related with it.

Comments are closed