Question: In an accounting system, the impact of each transaction is analyzed and must then be recorded. Debits and credits are used for this purpose. How does the actual recording of a transaction take place?

Answer: The effects produced on the various accounts by a transaction should be entered into the accounting system as quickly as possible so that information is not lost and mistakes have less time to occur. After analyzing each event, the financial changes caused by a transaction are initially recorded as a journal entry. A list of all recorded journal entries is maintained in a journal (also referred to as a general journal), which is one of the most important components within any accounting system. The journal is the diary of the company: the history of the impact of the financial events as they took place.

A journal entry is no more than an indication of the accounts and balances that were changed by a transaction

Question: Debit and credit rules are best learned through practice. In order to grasp the use of debits and credits, how should the needed practice begin?

Answer: When faced with debits and credits, everyone has to practice at first. That is normal and to be expected. These rules can be learned quickly but only by investing a bit of effort. Earlier in this chapter, a number of transactions were analyzed to determine their impact on account balances. Assume now that these same transactions are to be recorded as journal entries. To provide a bit more information for this illustration, the reporting company will be a small farm supply store known as the Lawndale Company that is located in a rural area. For convenience, assume that the company incurs these transactions during the final few days of Year One, just prior to preparing financial statements.

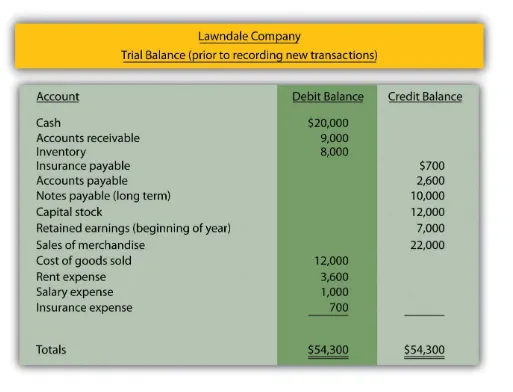

Assume further that this company already has the account balances presented in Figure 4.3 “Balances Taken From T-accounts in Ledger” in its T-accounts before making this last group of journal entries. Note that the total of all the debit and credit balances do agree ($54,300) and that every account shows a positive balance. In other words, the figure being reported is either a debit or credit based on what makes that particular type of account increase. Few T-accounts contain negative balances.

This current listing of accounts is commonly referred to as a trial balance. Since T-accounts are kept together in a ledger (or general ledger), a trial balance reports the individual balances for each T-account maintained in the company’s ledger.

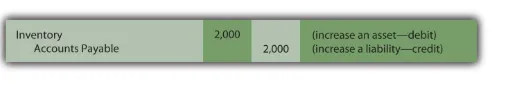

Question: Assume that after the above balances were determined, several additional transactions took place. The first transaction analyzed at the start of this chapter was the purchase of inventory on credit for $2,000. This acquisition increases the record of the amount of inventory being held while also raising one of the company’s liabilities, accounts payable. How is the acquisition of inventory on credit recorded in the form of a journal entry

Answer: Following the transactional analysis, a journal entry is prepared to record the impact that the event has on the Lawndale Company. Inventory is an asset that always uses a debit to note an increase. Accounts payable is a liability so that a credit indicates that an increase has occurred. Thus, the following journal entry is appropriate2.

Notice that the word “inventory” is physically on the left of the journal entry and the words “accounts payable” are indented to the right. This positioning clearly shows which account is debited and which is credited. In the same way, the $2,000 numerical amount added to the inventory total appears on the left (debit) side whereas the $2,000 change in accounts payable is clearly on the right (credit) side.

Preparing journal entries is obviously a mechanical process but one that is fundamental to the gathering of information for financial reporting purposes. Any person familiar with accounting procedures could easily “read” the above entry: based on the debit and credit, both inventory and accounts payable have gone up so a purchase of merchandise for $2,000 on credit is indicated. Interestingly, with translation of the words, a Venetian merchant from the later part of the fifteenth century would be capable of understanding the information captured by this journal entry even if prepared by a modern company as large as Xerox or Kellogg.