Question: The final step in reporting receivables at the end of Year Two is the estimation of the bad accounts incurred during this second year and the preparation of the related adjusting entry. According to the ledger balances, sales on credit for the year were $400,000, remaining accounts receivable amount to $160,000, and a $3,000 debit sits in the allowance for doubtful accounts. No entry has yet been made for the Year Two bad debt expense. How is the estimation of uncollectible accounts derived each year?

Answer: Much of financial accounting is quite standardized. However, estimations can be made by any method that is considered logical. After all, it is an estimate. Over the decades, two different approaches have come to predominate when predicting the amount of uncollectible accounts. As long as company officials obtain sufficient evidence to support the reported numbers, either way can be applied.

Percentage of sales method. This alternative computes doubtful accounts expense by anticipating the percentage of sales (or credit sales) that will eventually fail to be collected. The percentage of sales method is sometimes referred to as an income statement approach because the only number being estimated (bad debt expense) appears on the income statement.

Percentage of receivables method. Here, the proper balance for the allowance for doubtful accounts is determined based on the percentage of ending accounts receivable that are presumed to be uncollectible. This method is labeled a balance sheet approach because the one figure being estimated (the allowance for doubtful accounts) is found on the balance sheet. A common variation used by many companies is the “aging method,” which first categorizes all receivable balances by age and then multiplies each of the individual totals by a different percentage. Normally, a higher rate is used for accounts that are older because they are considered more likely to become uncollectible.

Question: Assume that this company chooses to use the percentage of sales method. All available evidence is studied by officials who come to believe that 8 percent of credit sales made during Year Two will prove to be worthless. In applying the percentage of sales method, what adjusting entry is made at the end of the year so that financial statements can be prepared?

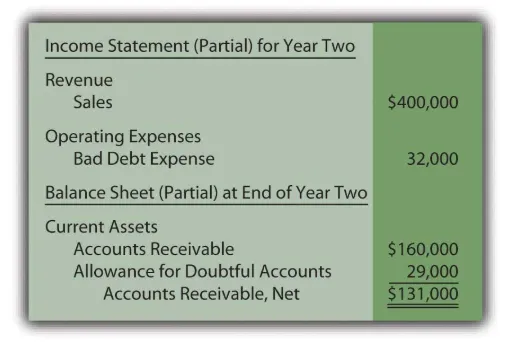

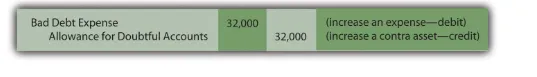

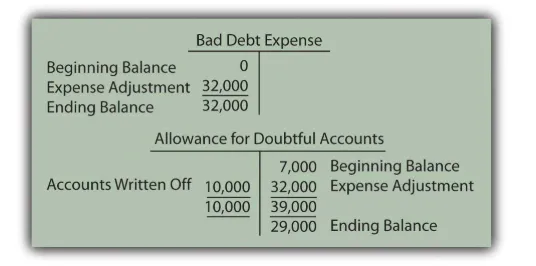

Answer: According to the general ledger, the company generated $400,000 in credit sales during Year Two. If uncollectible accounts are expected to be 8 percent of that amount, the expense is reported as $32,000 ($400,000 × 8 percent). Bad debt expense (the figure estimated) must be raised from its present zero balance to $32,000.

This adjustment increases the expense to the appropriate $32,000 figure, the proper percentage of the sales figure. However, the allowance account already held a $3,000 debit balance ($7,000 Year One estimation less $10,000 accounts written off). As can be seen in the T-accounts, the $32,000 recorded expense results in only a $29,000 balance for the allowance for doubtful accounts.

After this adjustment, the figures appearing in the financial statements for Year Two are as follows: