• Modern commercial banks perform a variety of functions and provide a number of services to their customers.

• They are regarded as departmental – store banks because they provide a wide variety of services to their customers.

Various functions performed by commercial banks are as follows:

1. Acceptance of deposits — People who have surplus funds with them would like to deposit these with commercial banks. Banks accept mainly three types of deposits:

Current Account:

• Deposits in current account are payable on demand.

• Current accounts are also known as demand deposits.

• These accounts are mostly held by traders and businessmen.

• Bank does not pay any interest on these accounts.

• Banks provide various services to the current account holders, such as making payment through cheques, collection of payment of cheques, issuing drafts on behalf of the account holders etc.

• Banks, in fact, levy certain service charges on the customers for the services rendered by them.

Savings Bank Account

• Here deposits are payable on demand and money can be withdrawn by cheques.

• Banks impose a limit on the amount and number of withdrawals during a particular period.

• These accounts are held by households who have idle cash for a short period.

• Deposits in this account earn interest at nominal rates

Fixed Deposits

• The money is deposited for a fixed period, viz., 6 months, one year, two years, five years or more.

• These deposits are not payable on demand.

• These deposits are also known as time deposits since the money deposited in them cannot be withdrawn before the maturity of the period for which the deposit is made.

• These are interest-earning deposits.

• The rate of interest varies with the length of time for which the deposit has been made.

• Recurring (or cumulative) deposits are one type of fixed deposits. A depositor makes a regular deposit of a given sum for a specified period.

• Recurring deposits are designed to motivate the small savers to save a particular amount regularly.

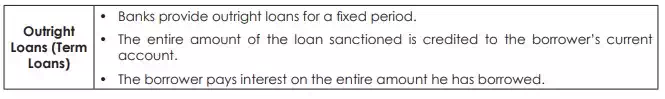

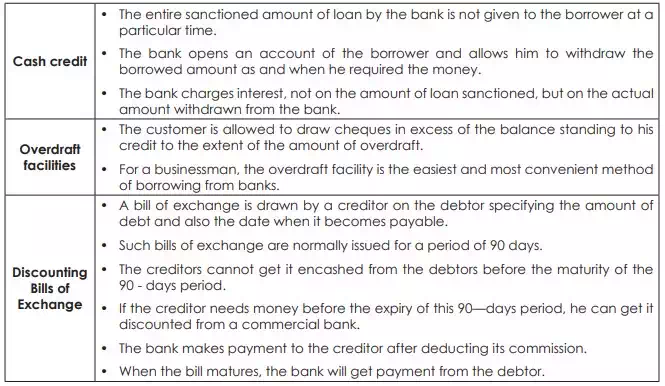

2. Advancing of Loans: The second primary function of the commercial banks is to extend loans and advances. Lending is the most profitable business of a bank. Banks charge interest from the borrowers which are more than the interest they pay to their depositors. Banks these days extend loans and advances to their customers in the following ways:

3. Facilitation of payments through cheques — Banks have provided a very convenient system of payment in the form of cheques. The cheque is the principal method of payment in business in recent times. It is convenient, cheap and safe means of making payments.

4. Transfer of funds — Banks help in the remittance or transfer of funds from one place to another through the use of various credit instruments like cheques, drafts, mail transfers and telegraphic transfers.

5. Agency Functions — Banks provide various agency functions for their customers. The banks charge commission or service charge for such functions. The main agency functions are :

(i) The commercial banks collect cheques, drafts, bills of exchange, hundies and other financial instruments for their customers.

(ii) They make and collect various types of payments on behalf of their customers, such as insurance premia, pensions, dividends, interest, etc.

(iii) The commercial banks act as agents for the customers in the sale and purchase of securities. They provide investment services to the companies by acting as underwriters and bankers for new issues of securities to the public.

(iv) They render agency services of various types, such as obtaining foreign currency for customers and sale of foreign exchange on their behalf, sale of national savings certificates and units of U.T.I.

(v) The commercial banks act as trustees and executors. For instance, they keep the wills of their customers and execute them after their death.

6. Miscellaneous Services – Commercial banks provide various miscellaneous services, such as provision of locker facilities for safe custody of jewellery and other valuables, issue of travellers cheques, gift cheques, provision of tax assistance and investment advice, etc.

7. Credit Creation — A very important and unique function of the commercial banks is that they have the power of credit creation. In the process of acceptance of deposit and granting of loans, commercial banks are able to create credit. This means that they are able to grant more loans than the amount of initial or primary deposits made by the customers. This function is discussed below in detail.